“CECL becomes effective for federally insured credit unions for financial reporting years beginning after December 15, 2022. Required regulatory reporting will begin with the March 31, 2023 Call Report. Institutions may adopt the standard sooner.” As stated by the NCUA in a recent update on CECL Resources.

This new accounting methodology replaces the previous Allowance for Loan and Lease Losses (ALLL) accounting standard, and focuses on estimation of expected losses over the life of the loans, whereas the previous relied on incurred losses. The effective date is inclusive of all financial institutions except for credit unions with total assets less than $10 million (12 U.S.C. §1782(a)(6)(C)(iii)). That is, unless explicitly required by State Supervisory Authorities under state law for federally insured, state-chartered credit unions.

CECL requires measuring all expected credit losses for financial assets held as of the reporting date based on historical experience, current conditions, and reasonable and supportable forecasts. All of this is dependent upon the integrity and accuracy of available data.

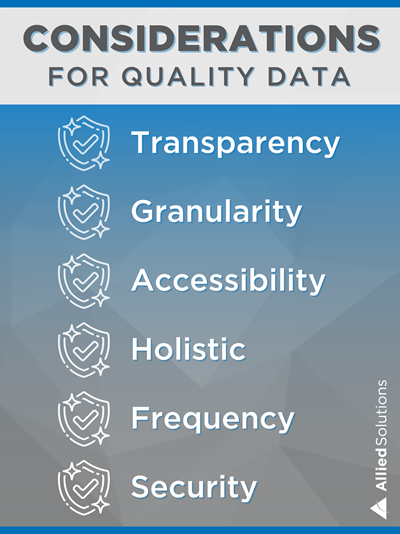

Here are six key considerations when evaluating data quality:

- Transparency – Understand how and where your institution’s data is stored. Having a clear process can minimize confusion when data is required to perform analysis. If a third-party vendor is used, certify accountability.

- Granularity – Depending on your institution’s processes and calculations, CECL may require more loan-level data. Be sure that the database can handle the increased volume as well as the capability to account for the entirety of loan life cycles.

- Accessibility – Data needs to be readily available in usable formats. Storing info across disparate systems or in unusable formats will cause accessibility and efficiency challenges in the future.

- Holistic data – Make certain that data is stored for the whole portfolio and not just for losses.

- Frequency – Data should be updated frequently to accommodate institution needs (i.e. process daily, archive monthly).

- Security – If the database is integrated with other solutions, it is important to confirm that data transferred between a core system and a vendor is secure. Data should be backed up frequently and have redundancy to minimize risk.

Notices of this update have circulated throughout the financial sector for more than five years and increasingly so as the original effective date was January of 2020. However, implementation was delayed multiple times to ensure companies had sufficient time to acquire better data, build more vigorous internal controls, and approach CECL implementation as a business solution.

Compliance is the minimum. Why stop there?

Now that you have access to extensive quality data, you shouldn’t let it go to waste. Basic compliance adherence isn’t enough. Financial institutions should maintain heightened focus on strategic growth with a solution that offers scalability in its approach to success. CECL estimates enable an improved capability of business decision-making. Proven algorithms allow institutions to see the components of the CECL estimate along with the reasons for change and visibility to concentrated segments and accounts.

With scenario driven, loan level, cash flow models for CECL, an analytics platform investment enables a broad range of future uses that span economic and climate cycles and geopolitical influences. This is especially important today considering the outlook on next year’s economy, as concerns about recession, inflation, and rising interest rates takes the top three spots of a recent Investopedia Reader Survey.

Financial institutions need to be judicious in solutioning for CECL requirements. This means leveraging an all-in-one solution that includes the necessary lifetime loss forecasts for CECL while providing accurate and actionable information for portfolio management, account management, and loan pricing. Your solution should be customizable to your institution and allowing updates to your forecasts at will.

Reduce fees, improve price, and optimize your portfolio by taking control of your participations. Loan model validations are also a key inclusion while solutioning advantageously. Validations should include: CECL, credit scores, collection queuing, price optimization, stress testing, anti-money laundering, or fraud.

Stay Connected

Financial institutions will progressively face challenges regarding the security of their systems. As the world continues to digitize and become more interconnected through shared data, concerns in the financial sector will be more prevalent than ever before. Consumers will also be more cautious when it comes to selecting or diversifying their financial needs, which will drive financial institutions to compete for customers by offering a wide range of services, rates, and benefits. Become a champion of their financial security.

As governments and regulators become increasingly concerned about consumer protection and financial stability, going into 2023 FIs will need to stay connected and be prepared for a rise in regulatory demands. Know your resources, utilize them, and communicate often. At the forefront of decision-making are maintaining an awareness of the potential impacts of climate change, natural disasters, and other environmental events, including the potential implications of the quickly evolving global economy. The steadfast capabilities you deploy will help you calculate and strategically influence how your FI is impacted in even the most volatile environments.

Did you miss Part 1? Check it out here: Risk Environment Part 1: How to Turn the Concept of Adverse Selection to Actionable Accountability