Mortgage Lender Placed Insurance (LPI)

- Credit Unions

- Auto Dealers

- Banks

- Finance Companies

- Mortgage Servicers

- Community

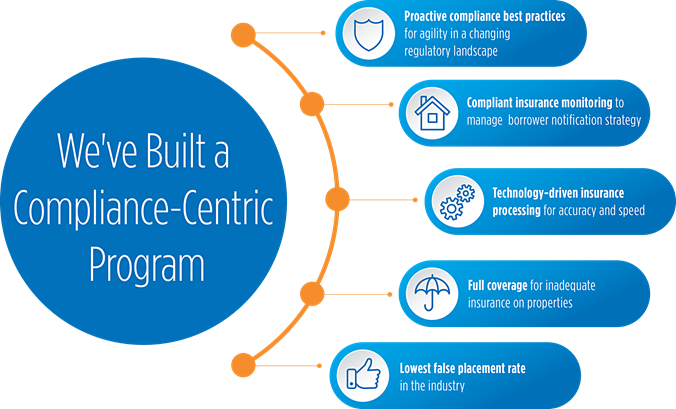

Mitigate Risk With Compliant Mortgage Lender Placed Insurance

Allied Solutions offers 40 years of experience and over 22 million loans tracked. We’ve discovered that while about 3% of borrowers don’t verify their insurance on their properties, less than 1% will remain uninsured after being informed of their requirement to maintain coverage.

Why protect your mortgage portfolio with Lender Placed Insurance (LPI)?

By tracking your borrowers' insurance to confirm they're properly insured, we aim to eliminate any unnecessary administrative burden, reduce false placement, and avoid losses.

Protect your residential and commercial portfolios with a full range of coverages and protection, including:

- Hazard coverage

- Flood coverage

- Wind coverage

- First mortgage protection

- Second mortgages and Home Equity Lines of Credit

- Real Estate Owned (REO) property protection, including comprehensive Hazard & Liability coverage for REO properties

For increased risk management, other solutions such as flood insurance monitoring, escrow services, and collections outsourcing can be integrated.

Our smart LPI includes:

- Compliant insurance tracking

- Electronic Data Interchange (EDI) with multiple mortgage carriers

- Timely and compliant delivery of insurance verifications

- One-call resolution with an award winning customer service center

- Delayed billing

- Lender dashboard with comprehensive reports

Allied's LPI program has been recognized industry-wide

The Center of Excellence recognition by BenchmarkPortal is one of the most prestigious awards in the customer service and support industry. Contact Centers achieve the Center of Excellence distinction based on best-practice metrics drawn from the world's largest database of objective and quantitative data that is audited and validated by researches from BenchmarkPortal. Learn more at www.BenchmarkPortal.com/contact-center-certification

The Center of Excellence recognition by BenchmarkPortal is one of the most prestigious awards in the customer service and support industry. Contact Centers achieve the Center of Excellence distinction based on best-practice metrics drawn from the world's largest database of objective and quantitative data that is audited and validated by researches from BenchmarkPortal. Learn more at www.BenchmarkPortal.com/contact-center-certification

Related Solutions

Streamline a system where lenders can request, cancel and manage insurance coverage in a fast, secure ...

Learn MoreMitigate losses associated with uninsured loan collateral through our robust insurance tracking system.

Learn MoreGet access to a national network of contractors with loan opportunities to source alternative financing ...

Learn More