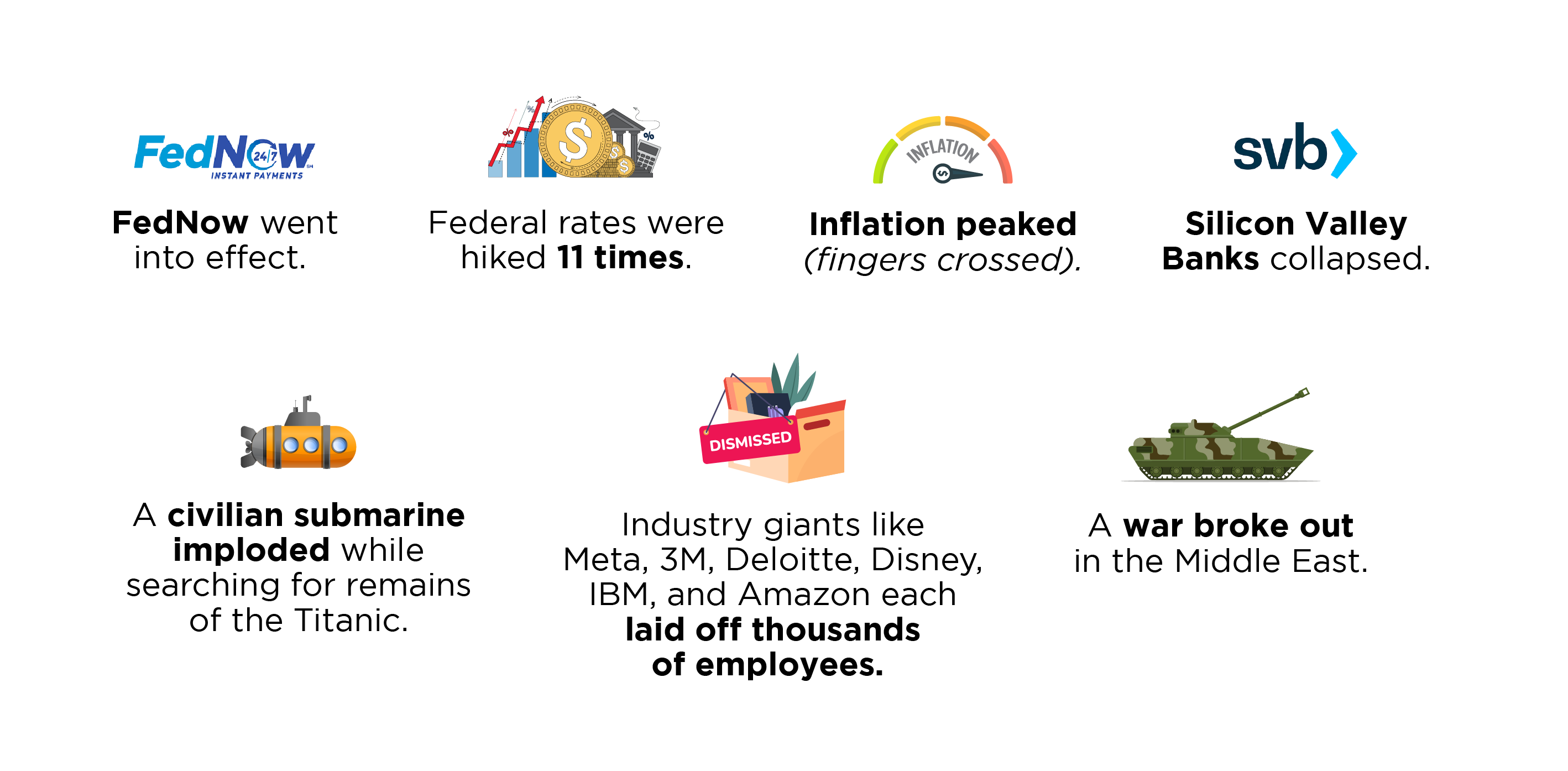

2023, what a year.

FedNow went into effect. Federal rates were hiked 11 times. Inflation peaked (fingers crossed). Silicon Valley Banks collapsed. A civilian submarine imploded while searching for remains of the Titanic. Industry giants like Meta, 3M, Deloitte, Disney, IBM, and Amazon each laid off thousands of employees. A war broke out in the Middle East.

And a partridge in a pear tree.

Whew. All that happened in one year?

Nearly four years removed from the pandemic and the economy is slammed with the after-effects of the Covid-19 extended shutdowns and mandates, uncommonly low interest rates, and cash flow from stimulus checks.

The resulting challenges don’t need to be rehashed: You have lived through them every day for the last year. You felt the weight of the after-effect of the pandemic in the boardroom and in the bottom line.

And yet –

In the midst of these challenges, financial institution executives and lending institutions rose to the occasion, exemplifying agility and flexibility like never before. At Allied Solutions we are inspired by our financial institution partners and our commitment to serving you is stronger than ever.

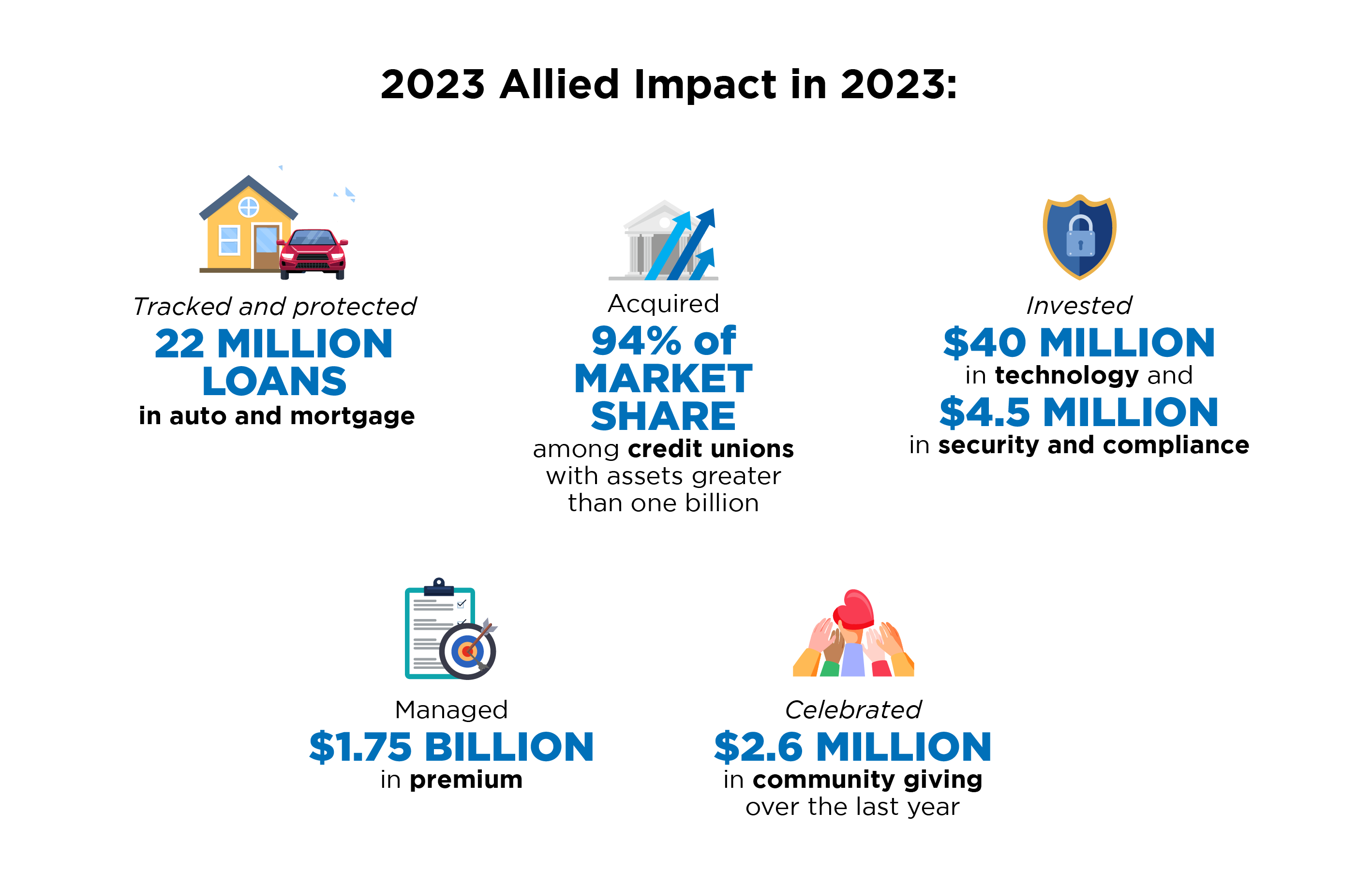

2023 Allied Impact in 2023:

We served 6,000 financial institutions and dozens of local communities this year. We look forward to the opportunities that the new year holds.

Predictions for 2024

2024 is a blank slate. We don’t know what exact challenges and opportunities will face us, but we do have some predictions.

Prediction #1: It’s going to be the survival of the digitally fittest.

The need to digitally transform isn’t slowing down. In fact, the financial institutions (well, any brand really) that have top-notch, seamless digital consumer experience will gain market share and grow profit. As AI continues to touch nearly every area of our lives, credit unions in particular need machine-learned tools to reach new and younger members.

Prediction #2: Gen Z will continue to be loyal to fintechs.

Gen Z is drawn towards the highly personalized experiences and digital features that fintechs and larger banks offer. Credit unions only hold about 4% of Gen Z’s market share, and it’s likely to drop each year that credit unions don’t leverage their brand, messaging, and digital tools to reach this demographic. Gen Z is generally un-loyal to brands that don’t fit their digital needs, and their business must be earned. Talk their language, consider a rebrand, take the steps towards capturing this large and growing share of the market.

Prediction #3: Compliance is a growing concern - and cost.

The CFPB has ramped up regulatory scrutiny towards financial institutions over the last 12 months - specifically around repossessions and product refunds on vehicle protection products. Additionally, digital banking will bring new cybersecurity threats that have to be responded to with appropriate compliance and prevention measures. New tools, processes, and legal assistance to maintain compliance will all require more budgetary space.

For financial institutions, the results of the next election cycle will be particularly impactful for compliance concerns. The ramp up or slowdown of additional lending compliance may hinge on the incumbent or change of administration.

Driving into 2024 with Confidence

The key to making confident decisions in the new year is to maintain a clear line of sight to compliant, digital transformation.

- Digitally evolve to reach younger accountholders.

- Be proactive about evolving compliance.

- Lean into your vendor partner relationships for new tools, trending insights, and strategic consultation.

Visit the Allied Solutions Resource Center for more insights.