Originally published on CUInsight.com

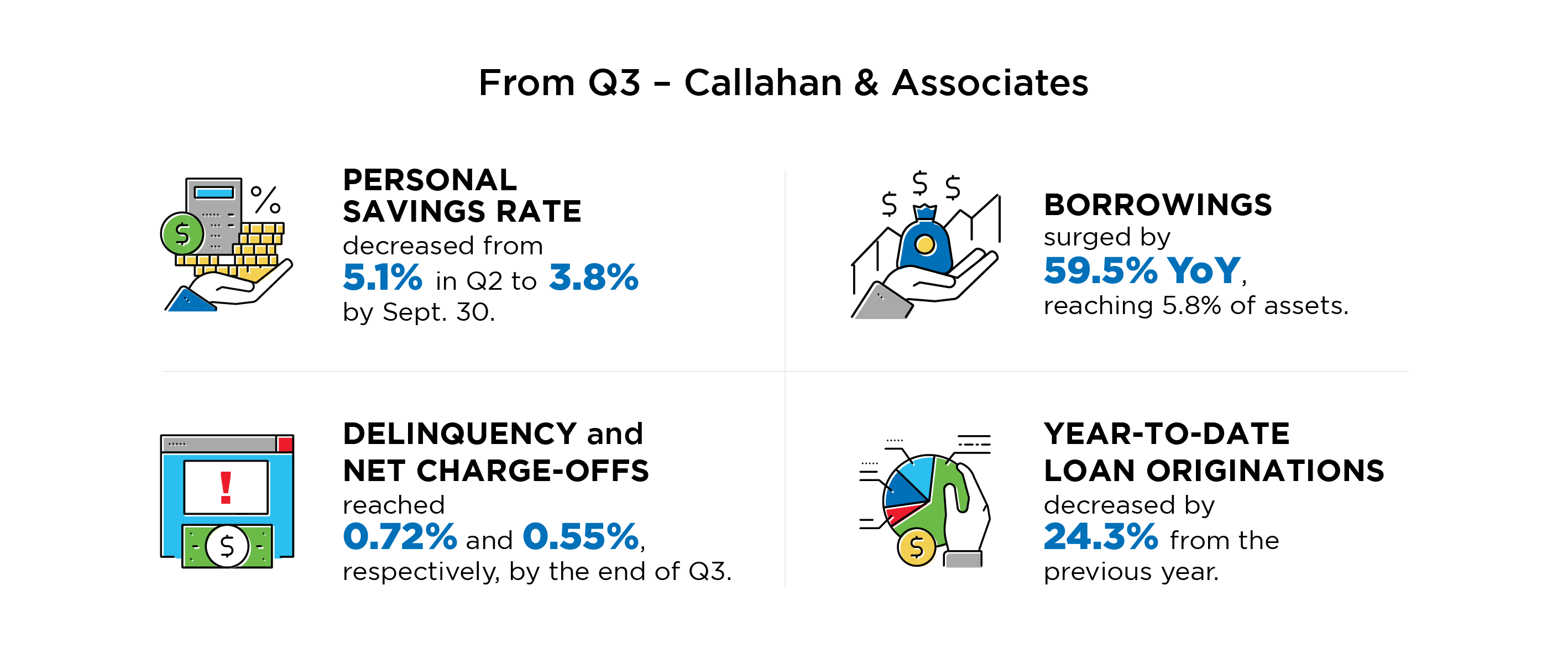

2023 has offered an assortment of learning opportunities, and as we highlight insights provided by Callahan & Associates from Q3[1] it becomes evident that credit unions are traversing a landscape equally marked by opportunities and challenges. Beyond the traditional metrics of savings, share growth, delinquency rates, and loan originations, our exploration extends to critical facets that demand attention and foresight when it comes to growth and managing risk.

Savings and Share Growth

While exploring trends in savings and share growth, credit unions should acknowledge the challenges faced by members in preserving their savings. The Battle for Deposits necessitates strategic measures such as promotional savings rates, extensive financial education, and personalized messaging to underscore the importance of saving. These initiatives not only boost member engagement but also contribute to long-term share growth.

Delinquency and Asset Quality

With delinquency and net charge-offs on the rise, credit unions need to concentrate on preserving asset quality. This involves bolstering risk management efforts, closely monitoring loan portfolios, and offering financial assistance or restructuring options to members facing challenges.

In November, Boston Consulting Group and TransUnion released a joint study[2] on how the resumption of student loan payments will impact loan delinquencies across all product categories.

Borrowings and Liquidity Management

As borrowings surge and credit unions diversify funding sources, optimizing liquidity management becomes crucial. Credit unions should evaluate and refine borrowing strategies, considering the implications of interest rate changes. This involves assessing fund costs, exploring alternative channels, and maintaining a balanced approach in utilizing borrowed funds. A proactive liquidity management strategy ensures stability in financial operations.

Check out the Allied Angle podcast: Lending in Limbo: Decoding the Wonky Financial Forecast

Loan Originations and Adaptive Strategies

With changes in Federal Reserve rate policies impacting loan rates and demand, credit unions must adopt adaptive strategies. Exploring niche markets, revising lending criteria, and introducing innovative loan products can mitigate the effects of fluctuating interest rates. An agile approach to loan origination positions credit unions to stay competitive in a changing economic environment.

Monitoring Economic Indicators

Stay informed about economic indicators, interest rate trends, and regulatory changes.

Given uncertainties in the economic landscape, credit unions should closely monitor external factors influencing their performance. This includes staying updated and leveraging analytics on interest rate movements, economic forecasts, and any regulatory changes impacting financial operations all with predictive forecasting.

Shift in Member Expectations

Consumer expectations are evolving, particularly in the realm of self-service. Credit unions must recognize this shift and adapt their services accordingly. Members now expect seamless and efficient self-service options. Integrating user-friendly digital interfaces, mobile banking enhancements, and intuitive online platforms can enhance the overall member experience.

Regulatory Pressure and Risk Mitigation

Credit unions are facing increased regulatory pressure, with the Consumer Financial Protection Bureau (CFPB) imposing fines[3] and the emergence of class-action lawsuits related to product cancellation and refund liability. It is imperative for credit unions to stay abreast of regulatory changes, enhance compliance measures, and proactively address potential legal challenges.

Considering the challenges posed by regulatory pressures, credit unions should place additional emphasis on risk management and mitigation strategies. This involves a comprehensive approach to identifying, assessing, and mitigating risks associated with financial operations. From stringent due diligence in product offerings to proactive identification of potential liabilities, credit unions can safeguard their interests and maintain regulatory compliance.

By prioritizing these strategic areas, credit unions can position themselves for growth, navigate challenges, and capitalize on opportunities in the evolving financial landscape. Your hands are not tied, credit union leaders must proactively adapt to overcome the familiarity of stagnancy, and gear-up for pivotal changes in the upcoming year.

1https://creditunions.com/webinars/trendwatch-3q23/

2https://media-publications.bcg.com/How-Resuming-Student-Loan-Payments-Will-Affect-Consumer-Credit-Risk.pdf

3CFPB Orders Toyota Motor Credit to Pay $60 Million for Illegal Lending and Credit Reporting Misconduct | Consumer Financial Protection Bureau (consumerfinance.gov)