Burnout. What comes to mind when you read that word? Maybe a deep, aching exhaustion from going 100 MPH resonates.

The not-so-good news: Burnout is real and all too common, with 28% of employees reporting that they feel burnout often.1

The good news: Burnout is preventable.

How can corporate burnout be prevented or corrected? How do financial institution leaders create a culture that keeps employees, at all levels, energized and engaged?

We’re glad you asked.

The Bottom Line Cost of Burnout

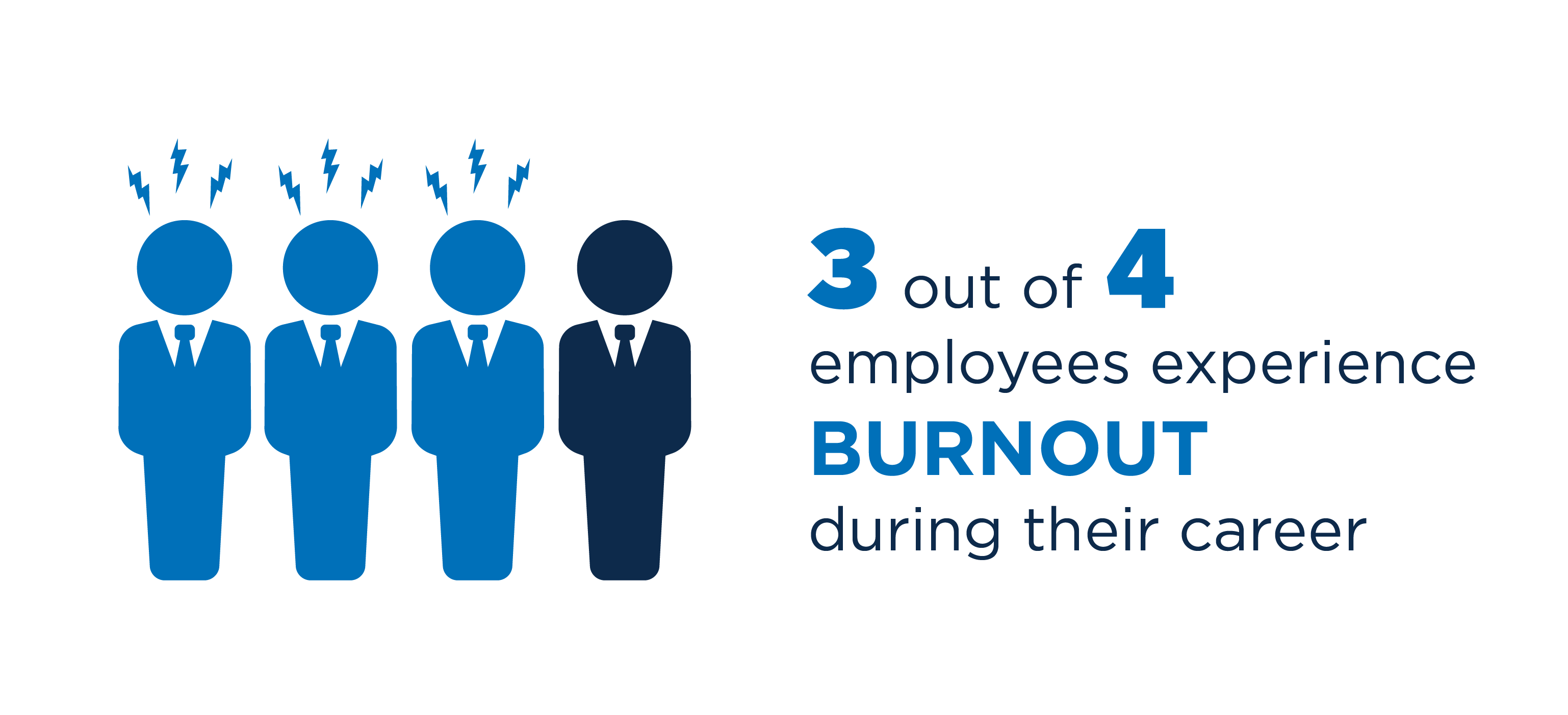

With three out of four employees experiencing burnout during their career, it is more common than leaders may think.1 Even though burnout is common, it shouldn’t be normalized (or glorified).

Burnout breeds disengagement which ultimately will impact the bottom line. Some experts believe that actively disengaged employees cost $8.9 trillion dollars.2 Your institution may feel its effects uniquely but some common impacts are rising healthcare premiums (due to insurance claim volume), higher payroll from higher turnover, and reduced productivity.

There’s no ignoring it: Employee disengagement is costly.

Individual employees (staff or leadership) are experiencing burnout but that doesn’t mean it’s an individual problem; it’s a work culture problem.

There are some shared cultural characteristics of companies with burnout-hire patterns. Companies with an imbalanced culture often:

- Frequently require employees to work outside the scope of their role for the sake of efficiency - without additional compensation

- Don’t map out growth opportunities for advancement and promotions

- Neglect ongoing coaching (like this)

- Enforce a zero-remote work policy

Does Valuing Mental Health at Work, Work?

Burnout and struggling mental health have serious side effects to the employee’s personal health. Imagine what burnout from multiple employees does to company’s health!

Since low engagement is a holistic problem, it requires a holistic approach.

Does your FI offer mental-health friendly perks? Considering implementing benefits like these:

- Ditching traditional bankers hours for non-front line staff

- Compressed work weeks

- Ongoing conversations about mental health and available resources

- Hybrid and work-from-home opportunities

- New or improved employee benefits and wellness plans

- Competitive retirement plans

- Job sharing and part-time opportunities

- Strong collaboration and communication between all levels of leadership and staff

- Succession planning consultation

Listen up leaders:

There’s no quick fix to a healthy, thriving workplace culture. You and your employees aren’t experiencing burnout because of a lack of digital transformation or not driving deposit growth (albethey important business objectives). Low engagement derives from the culture, specifically culture that needs rejuvenation.

You’ve seen the Great Recession and the Great Resignation, and (likely soon) the Great Refinance. What if next we create the Great Rejuvenation?

Everyone deserves to experience thriving wellbeing in a thriving workplace.

Get more insights and resources like this one delivered straight to your inbox. Choose from monthly and quarterly round ups of resources like these, plus news, trends, and other industry insights. Sign up here.

1https://www.gallup.com/workplace/406232/uncomfortable-necessary-conversations-burnout.aspx

2https://www.gallup.com/workplace/349484/state-of-the-global-workplace.aspx