Protection products, such as Guaranteed Asset Protection (GAP), are traditionally thought to be an add-on for new vehicles. Multiple factors in the auto market such as rising LTVs and declining used car values have made protection products such as GAP and Depreciation Protection (DPW) vitally important to financial institutions and their customers. In addition, vehicle repair costs have also risen nearly 20% compared to 2022, according to the Bureau of Labor Statistics. Mechanical Breakdown Protection (MBP) protects borrowers from expensive and unexpected repair costs. Ensure peace of mind for your members by learning more about protection products like GAP and MBP below.

The MBP Breakdown

The average age of vehicles on the road today has reached a record 12.5 years[1]. The likelihood of having an expensive repair, such as an engine or transmission replacement, increases with both age and mileage as owners hold onto their vehicles for longer periods. At a time where consumer credit card debt is at a record $1 trillion, expensive vehicle repairs are not ideal for most American’s bank accounts. In fact, according to BankRate.com, one in four American drivers would not be able to afford a $2,000 car repair if they needed one today.MBP helps alleviate the fear of a costly mechanical breakdown or vehicle repair. As an extra layer of protection for your vehicle, not only can MBP help cover the cost of repairs, including replacement parts and labor, but also can assist your members with 24/7 towing, emergency roadside assistance, and rental car reimbursement. MBP provides a strong benefit to your members while also generating significant non-interest income to your financial institution.

The likelihood of having an expensive repair, such as an engine or transmission replacement, increases with both age and mileage as owners hold onto their vehicles for longer periods. At a time where consumer credit card debt is at a record $1 trillion, expensive vehicle repairs are not ideal for most American’s bank accounts. In fact, according to BankRate.com, one in four American drivers would not be able to afford a $2,000 car repair if they needed one today.MBP helps alleviate the fear of a costly mechanical breakdown or vehicle repair. As an extra layer of protection for your vehicle, not only can MBP help cover the cost of repairs, including replacement parts and labor, but also can assist your members with 24/7 towing, emergency roadside assistance, and rental car reimbursement. MBP provides a strong benefit to your members while also generating significant non-interest income to your financial institution.

Filling in the GAP

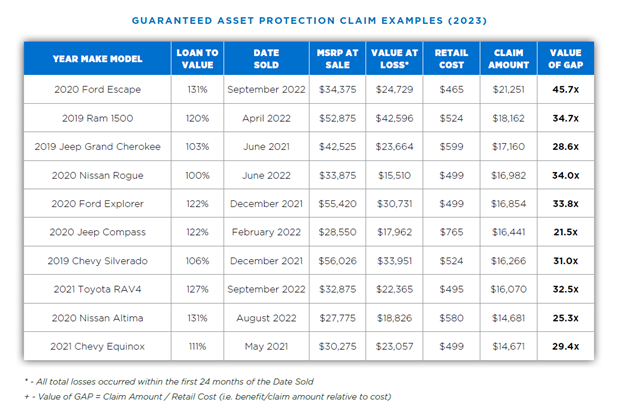

In the wake of the COVID-19 pandemic, rising interest rates and vehicle shortages have led to both increasing LTVs and extended loan terms on auto loans resulting in negative equity for borrowers. Guaranteed Asset Protection ensures that your members are protected in the event of a total loss by covering the deficiency between the loan balance and primary insurance settlement. GAP also pairs well with products like Auto Deductible Reimbursement (ADR). ADR is a complimentary benefit to the GAP program and reimburses your borrower up to their primary insurance deductible amount. The addition of ADR to a GAP program has shown to increase GAP production by 35% on average and in turn significantly expanding GAP revenue potential. See the chart below for real-time examples of how valuable GAP can be to your members.

Stop Depreciation in Its Tracks

As used car values decline and drivers keep their vehicles for longer periods, products like Depreciation Protection are vitally important to safeguarding a borrower’s positive equity and protecting against depreciation over the life of the loan. DPW locks in the value at the time of purchase and provides a benefit equal to the MSRP less the loan balance as of the date of the total loss up to a maximum benefit of $10,000, whichever is greater. DPW is also an excellent option for lower LTV loans where traditional GAP may not be a good fit. With complete integration into iQQ, quoting and selling DPW alongside GAP is made easy. Offering GAP in tandem with Depreciation Protection ensures protection for your entire vehicle portfolio and provides across-the-board protection for your borrowers in the event of a total loss.

Enhance Your Revenue

Protection products benefit your institution as much as they benefit your consumer. Not only do they provide additional revenue for your institution, but they can protect you in the event your member may be “upside down” on their loan if they have a total loss claim. These programs can be customized to help best fit your needs as a lender and offer easy administration and tracking through the vendor partner.

A strategic approach for both borrowers and lenders, protection products like GAP, MBP, ADR, and DPW is a win-win for all parties involved. Your borrowers can find peace of mind knowing they are protected from a total loss or unexpected, costly vehicle repairs while your financial institution can reap the benefits of additional revenue streams and satisfied members.

[1] S&P Global. May 2023. https://www.spglobal.com/mobility/en/research-analysis/average-age-of-light-vehicles-in-the-us-hits-record-high.html