BCP Beyond the Binder: Culture, Coaching & Succession

When disruption hits, the speed and clarity of your response come down to your culture, coaching, and leadership bench. Learn how strengthening the human side of continuity elevates every plan, checklist, and protocol you already have in place.

If there’s one thing financial institutions have learned over the last few years, it’s this: disruption doesn’t make an appointment. Cyberattacks, natural disasters, pandemics, system outages — none of them RSVP. And while every credit union and bank needs strong disaster protocols, cyber plans, and recovery procedures, there’s another critical layer of continuity that often gets overlooked: the people who bring those plans to life.

Because when something goes sideways, the difference between rapid recovery and prolonged chaos isn’t usually what’s written in the binder, it’s how prepared, aligned, and confident your people are in executing it.

Let’s break down why the “human side” of continuity planning has become one of the most important leadership conversations in financial services.

Culture: Your First Line of Defense

A well-built continuity plan is essential. But its success hinges on whether your people can carry it out under pressure. Or, as Mike Tyson famously put it: “Everyone has a plan until they’re punched in the face.” In mixed martial arts and self-defense, practitioners train response conditioning to override the amygdala hijack — the brain’s instinctive fight-or-flight reaction to crisis. The goal is simple: don’t react, respond.

Leadership continuity works the same way. Succession planning is the organizational equivalent of preparing the reflex before the hit lands.

A strong, consumer-focused culture isn’t built once a year in training. It’s built in everyday behaviors, shared language, and alignment around what “doing right by the accountholder” means in practice.

Strong culture = faster recovery, clearer communication, and fewer fires to put out.

Weak culture = inconsistencies, confusion, and elevated operational risk.

Culture sets the tone — but leadership brings it forward.

Coaching: The Real Accelerator of Stability

Coaching is one of the strongest predictors of employee engagement, capability, and resilience. Institutions with strong coaching cultures respond faster and more consistently during disruption because leaders know how to guide people through uncertainty, not just tasks.

Great leaders ask, align, inspire, and stabilize. Poor leaders… well, you’ve seen it.

“We’ll Figure It Out Later” Isn’t a Strategy Leadership gaps don’t just slow progress — they’re costly and create continuity risks. And many institutions remain vulnerable.

Here’s what the data shows:

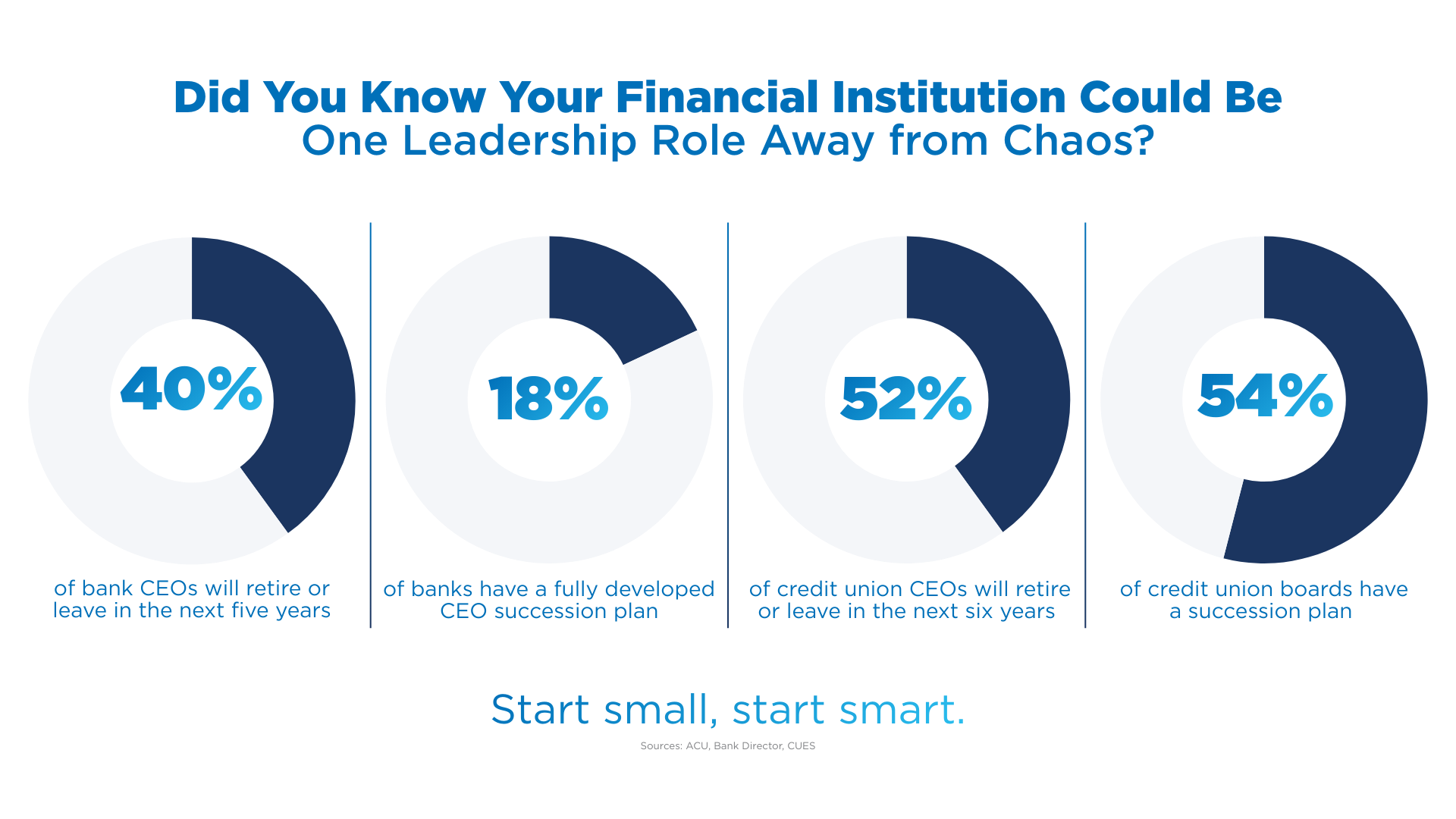

- Banks face significant risk with 40% of CEOs expected to retire within five years and only 18% having a fully developed succession plan.

- Credit unions face even higher upcoming turnover (52%) but show stronger preparedness, with 54% of boards having a succession plan in place.

- A final rule from the NCUA requires federally insured credit unions to have a written succession plan for key positions by January 1, 2026.

Translation: Many financial institutions are one unexpected resignation away from uncomfortable board meetings and operational disruption.

As Benjamin Franklin purportedly warned, failing to plan is planning to fail. And while “success” and “succession” have different Latin roots, it feels fitting that succession begins with success — add the “-ion,” and it becomes a noun of action and continuity. A reminder that leadership stability is an active choice, not a passive hope.

When you build a leadership bench, cross-train rising stars, and protect key roles with smart executive benefits, you safeguard continuity and consumer confidence.

Yes, You Still Need the Actual Continuity Plan

Tools matter, but tools don’t execute themselves. Disaster and crisis planning remain essential pillars of institutional safety. Your people need something solid to execute.

So yes, you still need:

- Disaster response protocols

- Cyber incident plans

- Accountholder communication templates

- Vendor contingency strategies

- Data backup and restoration procedures

- Remote-work readiness

- Pandemic playbooks (because… never again)

But here’s the truth: even the most thorough continuity plan depends on the people implementing it. The strongest institutions are not just checklist-ready. They are people-ready.

Continuity, Culture & Leadership: The New Power Trio

If you want a resilient financial institution, here’s the model:

Culture keeps people aligned.

Coaching keeps people capable.

Succession keeps people ready.

When you integrate these elements with your disaster planning, something powerful happens:

Your institution becomes stable, responsive, and confidently consumer-focused, even when the world gets unpredictable.

Now It’s Your Move

Business continuity isn’t an either–or. It’s not plans or people. It’s plans and people.

And the stakes are bigger than your org chart. Financial institutions are anchors supporting livelihoods, strengthening schools, sustaining small businesses, and fueling local economies. Continuity protects more than operations. It protects societies.

If you want true resilience, invest in the leaders and teams who carry that responsibility forward. Strengthen your culture. Develop your bench. Sharpen your continuity plan.

Because when disruption hits, it won’t just be the binder on the shelf that protects your institution, it will be the people ready to carry it out.