In today's digital age, ensuring that your banking website is accessible to all consumers, regardless of their abilities, is not just a matter of legal compliance; it's a crucial step towards creating an inclusive and welcoming online banking experience. A report from Deloitte on how banks can better serve those with disabilities surveyed 1,000 people who self-identified as having a disability and 1,000 caregivers. About half indicated that banks should elevate their experience with assistive technologies.

ADA Title III, indicates that banking institutions are obligated to ensure the accessibility of their websites and apps for consumers with disabilities.[1] In pursuit of this objective, banking websites must adhere to specific web accessibility standards.

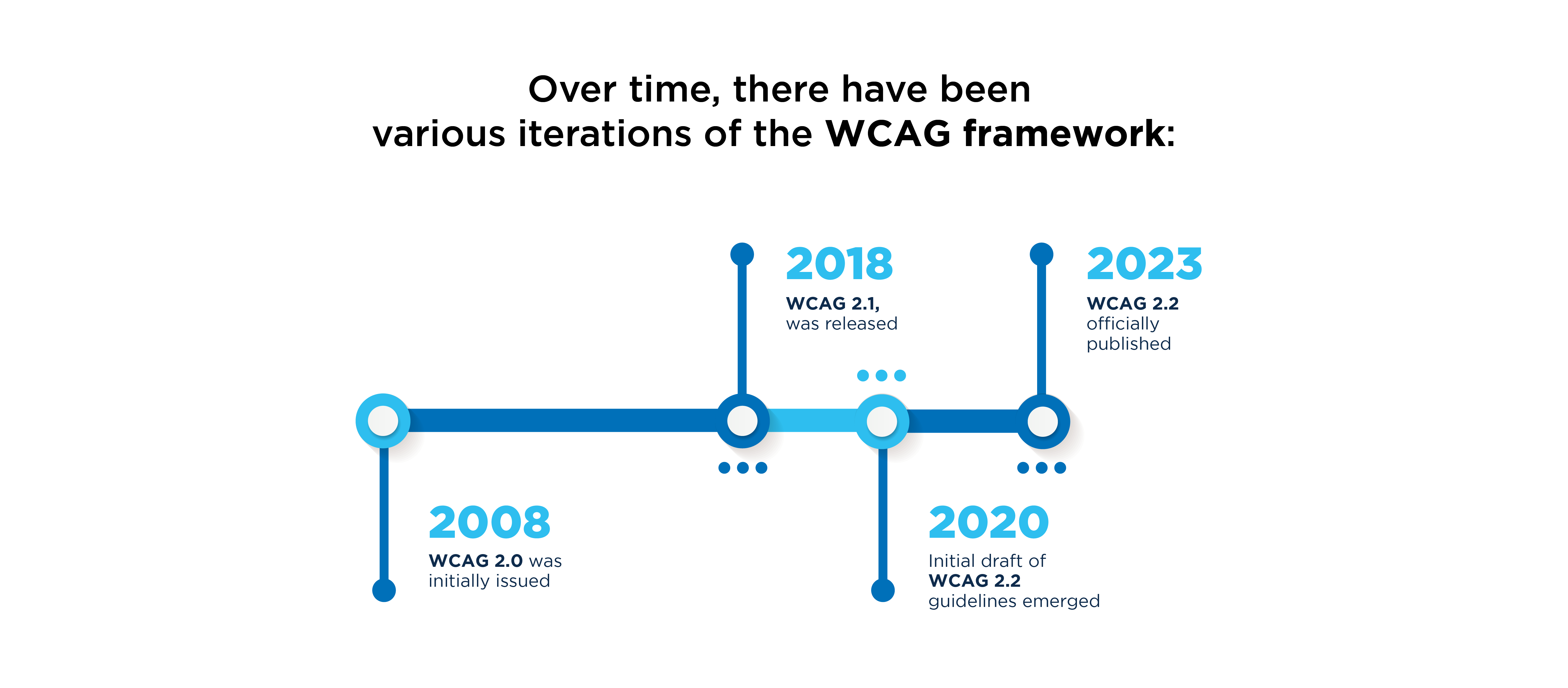

Numerous U.S. courts reference the Web Content Accessibility Guidelines (WCAG) as the established benchmark for web accessibility compliance in cases involving violations. The WCAG, developed by the World Wide Web Consortium (W3C), holds significant influence in shaping global web accessibility policies.

WCAG has three conformance levels: A (minimum), AA (commonly required), and AAA (optimal). In ADA-related cases, courts typically require WCAG 2.0 Level AA compliance. Conforming to WCAG 2.1 at Level AA reduces legal risk for banks.

Why does it matter?

- "As of 2018, 58% of banking websites failed accessibility tests that examine websites on four principles: perceivability, operability, understandability and robustness." [2]

- About one in ten (11%) customers find it 'fairly difficult' or 'very difficult' to navigate their bank's website. [3]

- One in three (30%) of those have memory difficulties. [4]

- 80.3 million people, representing 25.7% of the non-institutionalized population in the US, identify themselves as PWDs. Additionally, PWDs in the US control approximately $645 billion in disposable income. [5]

- 10.8% of Americans have cognitive difficulties, 5.6% have hearing difficulties, while 4.6% have vision difficulties. [6]

- Post-COVID, there was a 85% surge in online banking registrations in the US. [7]

For best practices, follow these key steps:

- Perform an Initial Audit: Ensuring WCAG and ADA Compliance

Before making any changes, start with an initial audit of your website to ensure it complies with current accessibility requirements outlined by the latest Web Content Accessibility Guidelines (WCAG) and the Americans with Disabilities Act (ADA). This audit will identify any existing issues that need to be addressed. - Schedule Regular Website Audits: Every Six Months

Website accessibility standards are constantly evolving, so it's vital to schedule regular website audits, at least every six months, to ensure your website continues to follow current standards. Regular audits will help you stay up-to-date and make any necessary improvements. - Collaborate with Developers: Regular Compliance Audits and Reporting

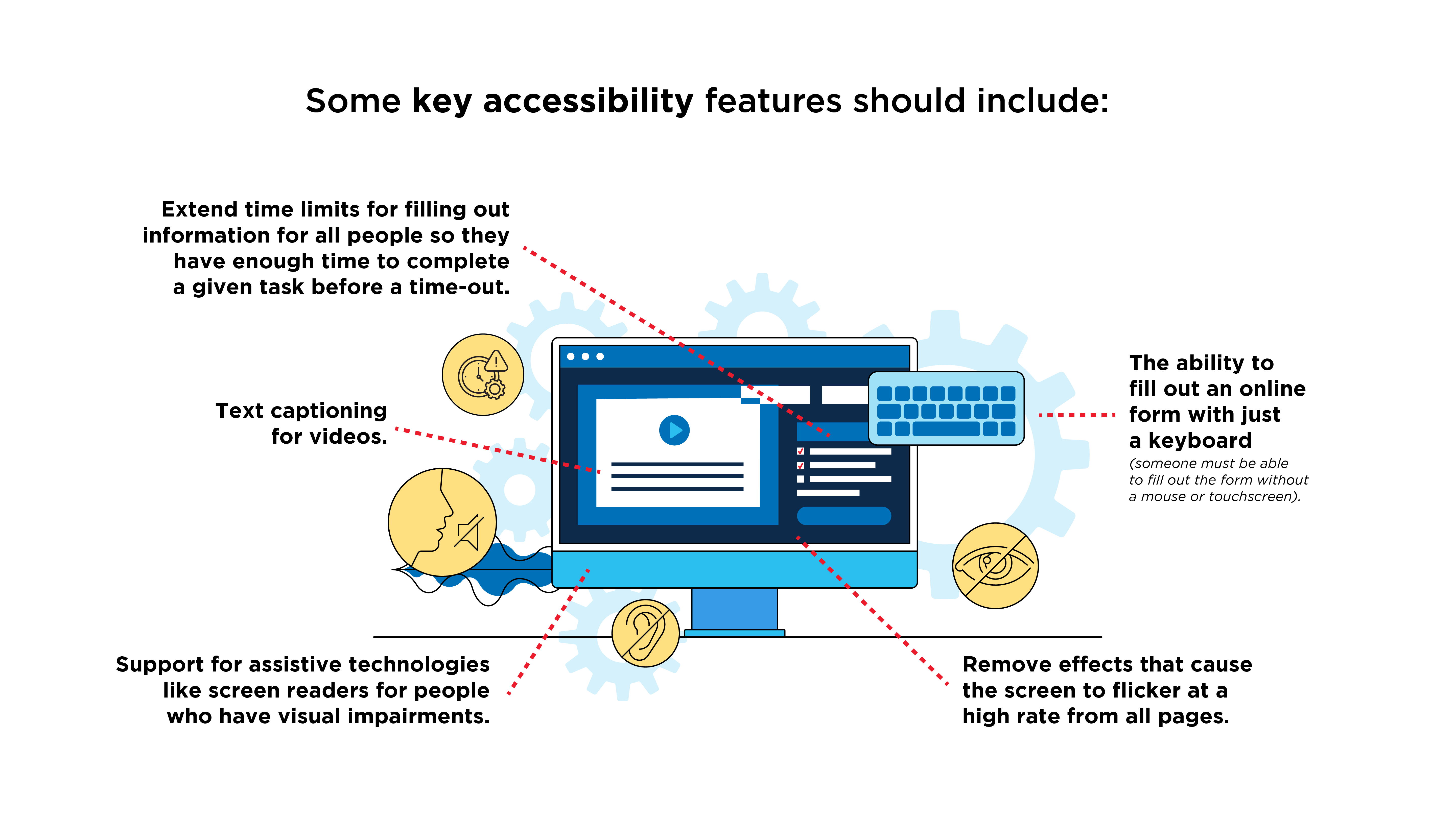

Engage your website developers to perform regular compliance audits that include written reports of the changes made and suggestions for additional improvements. This ongoing partnership will help maintain accessibility and keep your site in compliance. - Consider a Variety of Disabilities: Multiple Communication Methods

Consider individuals with various disabilities, including vision, hearing, learning, speech, movement, or cognitive limitations. Incorporate multiple communication methods on your site, such as screen readers to vocalize graphics and texts and closed captions on videos. This broad approach ensures that all customers can access your content. - Universally Accessible Functions and Processes

Ensure all functions and processes on your website, including online banking and loan processing, are universally accessible. This means that every user, regardless of their abilities, should be able to complete essential tasks without hindrance. - Display Contact Information Prominently

Make sure that your website's contact information is prominently displayed on the homepage and at the top of every page. This ensures that users with questions or issues can easily reach out for assistance. - Implement Required Compliance Trainings

Incorporate required compliance training for all staff and vendors involved with the development and upkeep of your website. Training is a vital component in maintaining an inclusive digital environment. - Partner with Experienced Vendors

Consider partnering with a vendor experienced in building ADA compliant websites. Collaborating with experts can streamline the process and ensure that accessibility is a top priority from the beginning. - Purchase Institutional Coverage

To protect your institution from potential legal risks, purchase institutional coverage that ensures coverage related to losses in the event of an accessibility-related lawsuit. This provides financial security and motivates ongoing commitment to accessibility.

By following these steps, you can create a banking website that not only complies with accessibility regulations but also fosters an inclusive environment where every consumer feels valued and welcome, regardless of their abilities. An accessible website benefits not only your consumers but also your institution's reputation and long-term success.

[1] https://www.ada.gov/law-and-regs/title-iii-regulations/

[2] https://equidox.co/blog/ada-compliant-pdfs-statements-on-demand-for-banks/

[3] https://disabilityhorizons.com/2021/07/which-research-finds-that-banks-are-lacking-accessibility-for-disabled-customers/

[4] https://disabilityhorizons.com/2021/07/which-research-finds-that-banks-are-lacking-accessibility-for-disabled-customers/

[5] https://sheribyrnehaber.medium.com/people-with-disabilities-control-8-trillion-in-spending-dabd43a87d81

[6] https://www.cdc.gov/ncbddd/disabilityandhealth/infographic-disability-impacts-all.html

[7] https://www.economist.com/finance-and-economics/2020/10/08/how-the-digital-surge-will-reshape-finance