When Protection Feels Personal: Why Borrower-Centric CPI Matters

Dear Credit Union,

I’ve been with you since my grandpa opened my first savings account when I was nine — adding checking, high-yield savings, a mortgage and, finally, an auto loan. At 32, I financed my dream of a mobile micro-winery — until Hurricane Helene washed my wine truck away.In an effort to save, I switched car insurers but forgot to update you in the chaos. When my next loan payment spiked, I called into member services and spoke with Marcus. He said,

“It looks like one of those rare cases where we didn’t receive your insurance details, even though you were covered. When that happens, we’re required to make sure the collateral is covered — just in case something happens to the vehicle. While we take extra care to verify coverage before lender-placed insurance is added, as a protection measure, not a penalty, this definitely slipped through the cracks and we’ll make it right.”

Once I sent my updated policy, you corrected my payment — and restored my trust.

Thank you for protecting not just my loan, but our long-standing relationship. In a stressful time, you made me feel like I mattered.

Sincerely,

Your Member

While there is some fictitious freedom taken in the member letter above, the frustration of false placement insurance is all too real.

In a recent episode of The Allied Angle podcast, it was observed that CPI has been around for decades, but the landscape today feels very different than it did five years ago. Delinquency rates are up and regulators are watching closely.

That shift means proactive programs should make false placements the exception, not the rule. And when something does slip through the cracks, fast fixes and genuine empathy turn frustration into loyalty.

Fewer unnecessary placements lead to a better member experience. By minimizing unnecessary placements, you safeguard your members’ trust and protect your loan portfolio.

Don’t wait for borrowers to initiate the verification process. By leveraging dynamic carrier searches, we can verify more insurance, faster, and with minimal borrower intervention.

Reducing Risk Without Raising Tension

Your members will never see the network of risk management vendors working behind the scenes — but they’ll feel the results. A seamless, empathetic experience is built through smart, borrower-first program features and the right partners.

How Allied Fuels Protection and Creates a Positive Member Experience

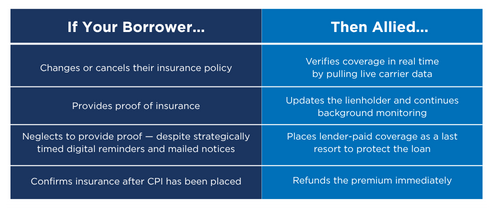

Most members never need lender-placed insurance. That’s why it’s critical to curate a positive experience for the few who do. A complete risk and recovery ecosystem begins protection at onboarding, tracks delinquency patterns, monitors policy updates, and —when necessary — places lender-paid insurance as a last resort.

In times of crisis, borrowers need to feel protected, not punished. By putting borrower needs first, credit unions can offer that protection while building a healthier portfolio.