Tax season is here, and with it comes an increase in identity theft resulting from tax scams.

In a typical tax scam, the fraudster reaches out to the victim disguised as an employee of the IRS or State, stating they want to help with tax filing or requesting payment on owed taxes. Tax scam emails typically include the tax service’s name and official seal, and may even link to a phony website to appear more official.

Don’t let your employees or accountholders fall victim to these crimes!

Education for Employees

W-2 forms contain a lot of sensitive information on employees, and are therefore highly sought after by identity thieves for filing fake tax returns. In fact, tax scams involving stolen W-2s have become one of the more dangerous email scams for tax administrations.

It is extremely helpful to train your staff on tax scam warning signs and prevention methods, so they are equipped to detect and report an attack, especially if they handle employees’ private information and forms (i.e. Payroll and HR).

Employees should contact the IRS if they experience any of the following tax scam warning signs:

- Extensions to file requests are rejected because a return with that Employer Identification Number or Social Security Number is already on file.

- An e-filed return is rejected because a duplicate EIN/SSN is already on file with the IRS.

- An unexpected receipt of a tax transcript or IRS notice that doesn't correspond to anything submitted by the filer.

- Failure to receive expected and routine correspondence from the IRS.

Education for Consumers

Since tax scams are a particular threat this time of year, it is especially important your accountholders know how to protect themselves from these prevalent attacks.

Accountholders should know that the IRS and state tax authorities would never reach out by phone, email, text, or through social media to ask for personal or financial information. So they should be extremely cautious of any of communications relating to their taxes, no matter how “official” the communication may seem.

Below are obvious tax scam red flag to be aware of, as the IRS and state tax authorities would never do the following:

- Request taxes are paid by a prepaid/reloadable debit card, gift card, or through a money wire service (i.e. like Western Union or MoneyGram).

- Call to discuss/demand payment on owed federal or state taxes, without first mailing you an official bill.

- Email about a tax discrepancy or bill with a threat to audit if the payment is not made right away.

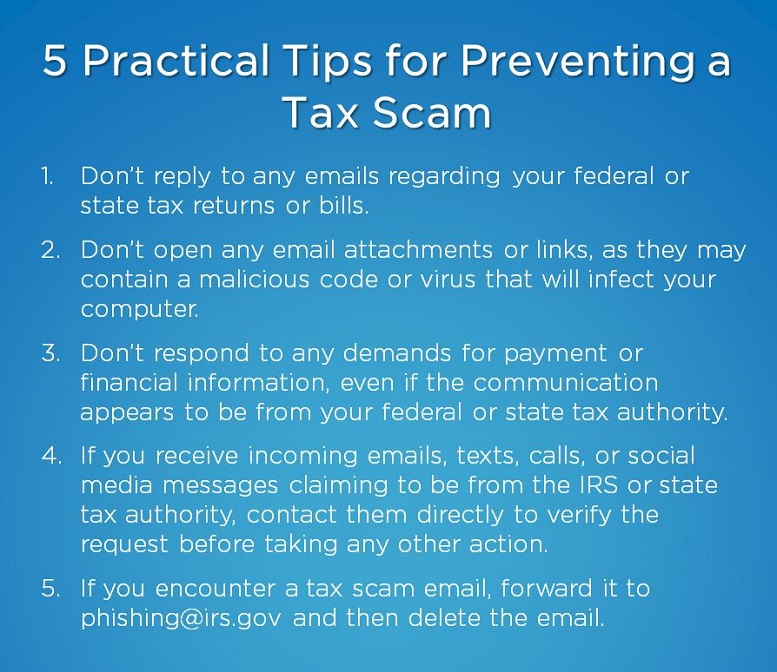

These tax scams are sure to increase in the coming months, so don’t wait to start educating your staff and accountholders about these crimes! Share the following tips with your employees and accountholders to protect against a tax scam.

Click here to sign-up for our Fraud & Security Risk Alerts and receive ongoing education about top-of-mind fraud & security risks.

Click here to learn more about how Allied Solutions is helping our industry prevent and manage fraud.