Read the full blog article on NAFCU Services Blog.

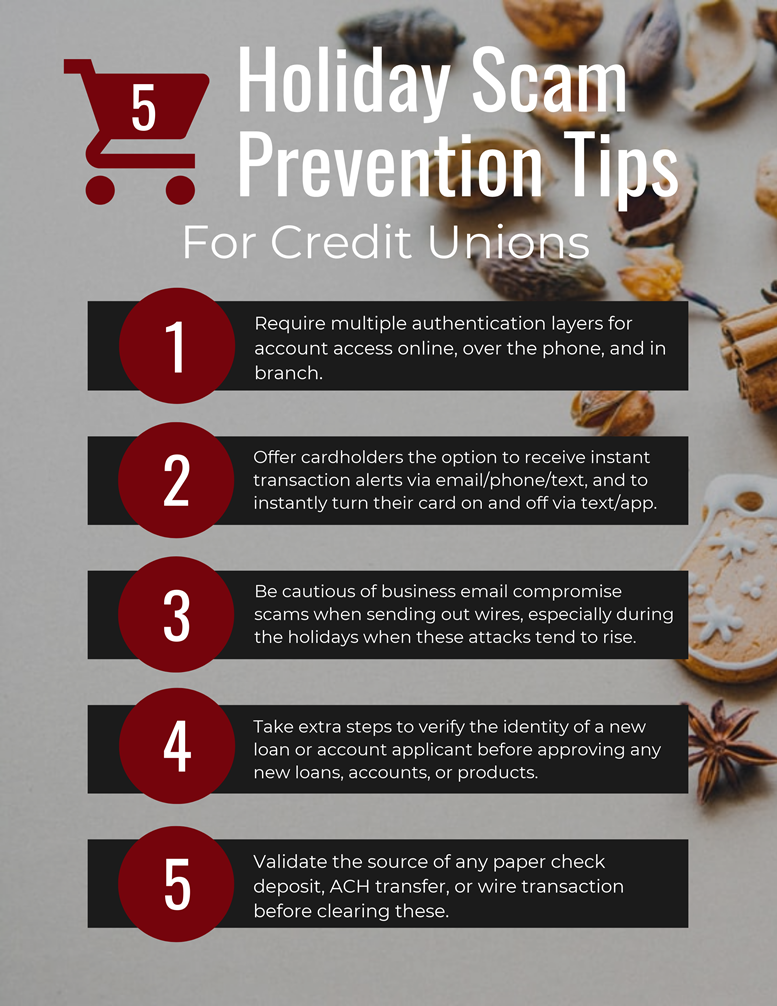

The holiday season is in full force. And while this time of year brings more business opportunities for credit unions, it also brings more risks. Member scams, transaction risks, and loan application fraud attempts all ramp up during this purchase-heavy time of year. It is important your credit union stays alert to these fraud threats and continues to put fraud education in front of employees and members. Review and share the following holiday-related scam education to keep the season merry and bright:

Download our White Paper: "Risk Checklist: Holiday Scam Prevention For Financial Institutions and Consumers"

Click here to learn more about credit union risk solutions at Allied Solutions.