LOAN GROWTH BLOG SERIES PART 3 — FOUR WAYS "BIG DATA" CAN ENHANCE YOUR LENDING PROGRAM

Consolidating and analyzing data is a key component in understanding the wants and needs of current and prospective consumers.

“Big Data” – which includes structured and unstructured consumer data – can tell you what your consumers want, what they don’t want, how they want it, when they want it, and can even go so far as to predict their potential risks and desires now and in the future – you just have to know what data to look for and what to do with it once you find it.

The same is true of data used for lending: Compiling and leveraging the right data insights can help you to expand the reach and profitability of your lending portfolio in a highly effective way. Looking beyond FICO’s credit scoring model is a good first step. If you look to these credit scores as your singular data source when defining loan eligibility, you are pigeon holing yourself to a small segment of the market that large national lenders are competing for and missing the larger growth opportunity.

Painting a more complete and accurate picture of your borrowers requires that you consolidate as much consumer data as you can access, including:

- Business systems across your organization (i.e. core processor, LOS, card processing and marketing systems)

- Consumer engagement channels (i.e. social media pages and website interactions)

- Third party data (i.e. bureaus, behavioral and purchase habits, Lexis Nexus, Amazon, etc.)

- Outside market analysis and data sources (i.e. predictive and prescriptive analytics data models)

Once you have this data on hand, you’ll be able to identify consumer profiles and trends that can be leveraged to expand you lending program in the following ways.

1. Expand loan models & underwriting guidelines

One of the most important pieces of advice I can give is this: Expand beyond traditional financing and traditional borrowers!

Traditional underwriting models tend to carry stricter guidelines and repayment plans, which can be a big challenge when trying to attract and entice new consumer demographics, like Millennials and near-prime borrowers. Fortunately, there are many ‘non-traditional’ loan types that can help you tap into these expanded markets.

Read the Blog: How to Achieve Lending Growth in an Increasingly Crowded Market

Real-time engagement and transaction data can be leveraged to help determine what new loan offerings and financing options are best suited for your consumers. Examples of these data sets include:

- Banking and deposit data can further indicate a consumer’s current and predictive financial profile, namely ongoing deposits from an employer/elsewhere and ongoing spending habits.

- Social media interactions and history can supply further enlightenment on the level of risk/reward a prospective consumer can provide. You can determine their employment role and history, trajectory of that role and future income potential, whether they are a spender or saver, etc.

- Predictive and prescriptive data models available in the marketplace can be leveraged to help you more comprehensively define a consumer’s current and future risk/reward profile, and as a result determine which product and loan offerings make most sense for this borrower and your financial institution.

Drawing up trends and insights from these and other third party data sources can help you make more educated conclusions about how to expand your underwriting requirements and loan types in a way that would most effectively attract untapped markets and consumer demographics.

2. Attract new loan business

Existing consumer data can also be used to generate new financing opportunities for existing consumers. By identifying an individual consumer’s stage of life, product haves (and don’t haves), buying history, payment history, and interaction history you can build insights around when and how to offer them relevant loan offerings through various triggers.

Taking this a step further, certain life events can be leveraged for triggering timely, relevant cross-sell and loan offers to individual consumers. Take the following examples of life events that could be flagged for specific loan offers:

- Trigger: Lease : Lease end – Targeted offers: balloon note financing or short term loans

- Trigger: Graduates from college – Targeted offers: student loan refinancing offers or flexible loan repayment plans

- Trigger: Increased credit card spending for business items – Target offers: small business loan, business credit card with benefits, investment services, business services (payroll, etc.)

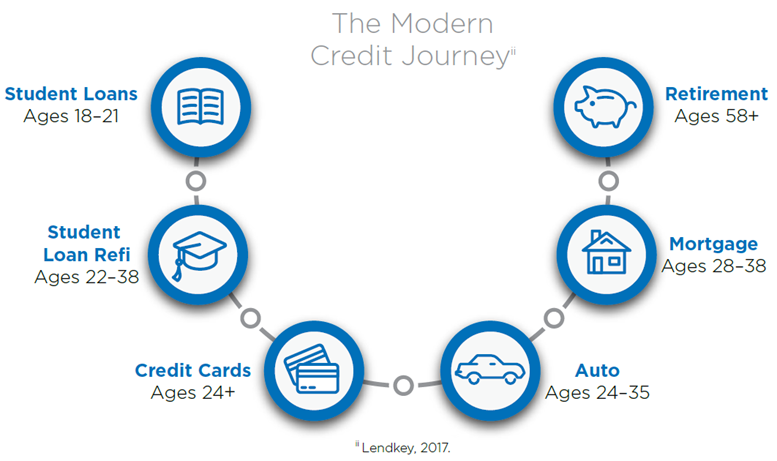

The following diagram is also a great indicator of how to segment your consumer markets for submitting targeted, personalized loan offers that tie into their life stage and credit journey:

3. Better serve existing borrowers

Modern borrowers across all stages of life have become accustomed to a certain level of “easy button” service as a consumer in this digital age. As such, they all now come to expect the type of service in all of their consumer interactions – this is more the case for younger demographics, but is also true of older demographics.

Read the Blog: How to Build a Loan Program that Appeals to Millennials & Baby Boomers Alike

Using available data to help understand your consumer’s behaviors can help you address their product and servicing needs when and how they prefer. This goes beyond offering them timely offers into communicating with them through their preferred channel of communication.

The more effective and personalized your communications, the more likely your consumers will respond positively to these interactions, which will build their trust in your organization and in turn lead to more direct and indirect business through your consumers and their personal networks.

4. Protect against loan risks

Data is also an integral player in protecting your business from expected and unexpected loan risks. For starters, if you are planning to expand your loan offerings beyond the prime and super-prime markets (which you definitely should) it helps to look at your data to capture – and even predict – loan default risks.

Previous loan data, banking and deposit data, geo tracking data, license plate recognition data, and insurance tracking data are all places you can look to spot red flags for loan default risks, as well as other types of financial loss risks.

Predictive analytics models are also quite valuable for enhancing your lending institution’s risk modeling and pricing to ensure a favorable ROI on your portfolio. You can build this model yourself using the data you have on hand, or you can partner with an organization to build a custom risk model (like our Predictive CPI service) that predicts, monitors, and sends communication regarding loan risks on behalf of your organization.

Consolidating and analyzing your data is the only way to gain a complete picture of your consumers – which is a must if you stand a chance at building loan business in spite of the growing competition. Additionally, aggregating your data can help you allocate capital more effectively across your loan portfolio, in real time and can help you to get ahead of regulatory and compliance demands from the likes of CECL and other potential data-related requirements.

The good news is this task of consolidating your data doesn’t have to be daunting or pricey. If you start where you can and lean on as much support as possible you can start leveraging your data immediately and build your data strategy one piece at a time. But you should really start now!

Read the first installment of this blog series: "How to Achieve Lending Growth in an Increasingly Crowded Market"

Read the second installment of this blog series: "How to Build a Loan Program that Appeals to Millennials & Baby Boomers Alike"

Contact us to ask what programs we offer that can help you expand your lending program.