On a recent episode of NAFCU’s "The CU Lab" podcast, Allied’s own Jarrett Settles (National Sales Consultant | Technology, Lending, and Deposit Growth) got together with two other industry experts – Will Sneed, Director of Lender Partnerships at LendKey and Ron Shevlin, Director of Research at Cornerstone Advisors – to talk about why Student Lending is something every credit union should consider.

Here are three of the biggest takeaways from that recording:

Listen to the Podcast Episode: Leverage Student Lending to Drive Millennial Membership

1. 92% of national student loan debt is from federal – not private – student loans

The student loan market is still growing. In fact, the national student loan debt exceeded $1.4 trillion in 2019,[1] growing far beyond that of 2018, with an average 1 in 5 consumers having student loan debt.[2]

However, this debt primarily comes from the federal student loan market, making up 92% of the total student loan debt.[3]

So while there is a lot of headline risk associated with student loans, private student loans are credit-based and do not carry nearly as much risk as needs-based federal student loans.

2. Private student loans can lead to lasting growth for credit unions

The continued growth in loans offers a huge opportunity for credit unions.

Borrowers have an average $31K in outstanding student loan debt, most of which are federal loans.[4] There is a lot of emotion attached to this debt, with many consumers feeling frustrated with their current situation. Offering a less expensive refinance opportunity can alleviate this worry and stress and earn the business and trust of a critical member demographic.

Building these relationships early on in the member’s credit cycle quite often result in long-lasting, profitable relationships with these members. A 2019 Cornerstone study, Lifetime Value of a Student Loan Relationship,[5] looked at consumers with private student loans ten years leading up to survey. This study uncovered that 6 in 10 consumers who applied for a student loan opened another kind of account (credit cards, savings accounts, mortgages, and home equity loans) at the financial institution, even if it was not their primary institution.

Read our White Paper: "How to Talk Finance: How and Why Every Generation Spends Their Money"

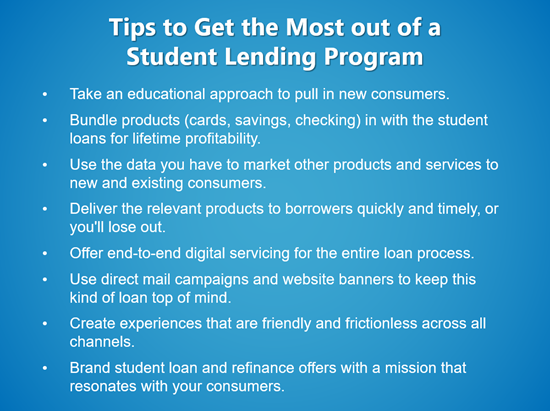

Other benefits of private student loans & student loan refinancing:

- Diversification: Unsecure student debt is an essential category for diversifying the loan portfolio, while at the same time helping to increase yield

- Competitiveness: Commercial lending and student lending will be sought out elsewhere, and there are a growing number of fintech companies trying to draw in this critical demographic away from your credit union

- Demand: There is currently a high demand for folks needing to fund their schooling

3. Partner with a qualified vendor to offer student lending

There are three ways to kick-start a student lending program: Buy. Build. Or Partner.

Partnering with a company is arguably the easiest and least daunting among these three options. If you choose to partner with a vendor to offer student lending, you’ll need to do your homework.

Here are the top qualities to seek out in a student lending partner:

- They have experience in working with credit unions

- They understand tech and digital or even brand themselves as a fintech organization

- Their core values align with your credit union

- They are risk-conscious, i.e., offer geographic diversification and compliance support

Ron Shevlin said it best: “When call reports go out for both 2019 and 2020 there will be a sub-set segment of credit unions who will demonstrate some really strong profitability as a result of having expanded and diversified into the private student loan market. And other credit unions will look around, going ‘How did they do that?’”

Learn more about Allied’s student lending programs.

[1] https://www.experian.com/blogs/ask-experian/state-of-student-loan-debt/

[2] https://www.nbcnews.com/news/us-news/student-loan-statistics-2019-n997836

[3] https://www.nerdwallet.com/blog/loans/student-loans/student-loan-debt/

[4] https://www.credit.com/personal-finance/average-student-loan-debt/

[5] https://www.crnrstone.com/publications/the-lifetime-value-of-a-student-loan-relationship/