Extinguishing C-Suite Burnout

At this point, most of us are familiar with the Great Resignation that catapulted in early 2021. Employees seemingly revolted across the country, uniting against the workplace status quo following the changes and challenges of the pandemic. Subsequently, 2022 saw “quiet quitting” and the even more clamorous “loud layoffs” take over the top headlines. Contrary to popular belief, a survey that polled 400 human resource executives found that the departures during the Great Resignation were almost evenly spread across entry-level, mid-level, and senior-level/C-suite employees. While we hope that COVID-19 and its accompanying effects on most businesses are a once-in-a-lifetime event, how do financial institutions pivot to create a culture that keeps employees, at all levels, on the payroll?

The Why Behind the Why

The first few months of the pandemic slowed life down for many people. A new stay-at-home lifestyle gave people a chance to reflect on their career paths, personal lives, and (mental) health. Priorities were realigned and work-from-home/hybrid careers started to become more common and attractive to job seekers — and businesses were either accepting and adaptive to these changes, or they weren’t.

Driven by low pay with even worse benefits, additional pandemic-based factors gave way for employees to focus on what matters most to them. These factors included:

- Being overworked without additional compensation (due to staffing shortages

- Being mistreated (largely due to the effects of being short-staffed)

- Lack of advancement opportunities

- Being forced back into an office after working remotely

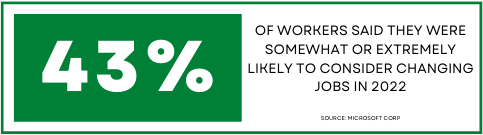

Employees began leaving their current jobs to find something better and more fitting for their lifestyle, whether it was a new job, becoming an entrepreneur, or converting to a one-income household. However, it didn’t stop there. According to a recent survey by Microsoft (PDF download), 43% of workers said they were “somewhat or extremely likely” to consider changing employers in 2022, versus 41% in 2021.

The Great Resignation Burnout

C-suite executives in the financial industry have dealt with a lot since 2020, largely due to blindly navigating their institutions through a time unlike any other we’ve known, while still competing to attract top talent, adjusting (on the fly at times) to retain talent, and constantly repivoting due to inflation, supply chain, and other economic factors.

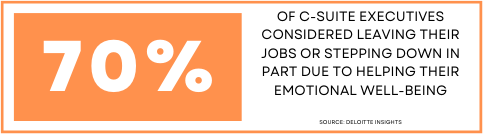

That’s a lot of pressure, even for a select group of highly skilled professionals. And for some C-suite executives, the pressure just isn’t worth it. Mental health and well-being awareness has skyrocketed over the last few years, leading executives to prioritize themselves and their families over promotions and big bonuses. A study by Deloitte Insights found that 81% of C-suite executives considered themselves to be health-savvy, and 70% of them are proving it by considering leaving their jobs or stepping down largely in part due to helping their emotional well-being. Notably, 76% of the executives attributed the pandemic as having a negative impact on their overall health.

Start at the Top

Now that we are post-pandemic, it’s time to focus on creating a culture that caters to the demands of the post-pandemic employee. Starting with the C-suite executives, offering benefits that attract (and keep) top talent, and providing tools to help them lead a successful team can help them grow a new culture that shows entry and mid-level employees your commitment to them and their well-being.

Additional changes your institution can implement, if applicable, to benefit employees on all levels include:

- Flexible working time

- Compressed work weeks

- Hybrid and work-from-home opportunities

- New or improved employee benefits and wellness plans

- Competitive retirement plans

- Job sharing and part-time opportunities

- Advancement and growth opportunities

Navigating a new way to run a financial institution, or any business can be complicated when values and demands have changed. Improving your culture, actively staying connected with your employees, and accessing their needs regularly can only make your institution more alluring and sought-after by job seekers.

Stay in the know all year long with Allied Insights! Our e-newsletters include monthly and quarterly round ups of resources like these, plus news, trends, and other industry insights. Sign up here.