Artificial Intelligence, Cannabis Banking, and Product Refund Liability: A Round Up of Hot Topics for FIs

For over four decades, Allied Solutions has provided the financial sector with deep insights. Researching industry trends and compiling compelling data is what we do best, and we do it because we care about growing, protecting, and evolving your business in 2023 and beyond.

Let’s say “cheers” to the New Year with a roundup of the most popular blogs for lenders.

- Humanizing Business with Artificial Intelligence

Artificial Intelligence. The buzz phrase of 2022 (like “new normal” was of 2021.)

Some financial institutions are fearing that the addition of AI will hurt accountholder relationships, however, 68% of consumers want more artificial intelligence in their life. Get the most out of your artificial intelligence program and prioritize accountholder relationships. Read the blog here. - Digital Transformation: It’s Time to Cook or Get Out of the Kitchen

AI is just one piece of the digital transformation puzzle. And it’s just that for many financial institutions: a puzzle. Here are some key pieces of a digital optimization strategy to position you for relevance and digital agility in the coming years. Click here to read the blog. - Sign of the Times 3-Part Series

Cryptocurrency. Supply chain concerns. Catering to multi-generational banking needs. These pertinent topics are covered in our 3-part series. Read them all for timely insights on these trending business needs.- Banking without Borders

As a financial institution leader, you may recognize the growing value and importance of cryptocurrency, but may also feel overwhelmed by the regulatory weight that comes with the territory. Part one of this series identifies consumer pain points associated with digital currency and how to find the right next steps for your financial institution. Read part one. - Supply Chain Economy: Framework for the Future

Part two of the series dives into the economic impact on supply chain processes, and some common missteps that make matters worse. Learn how your financial institution can leverage data intelligence to create a smooth, streamlined path forward. Read part two. - Banking for the Ages

Financial institutions must cater to the financial needs of multiple generations. Baby Boomers down to Generation Alpha each have their own set of values and expectations. The final installment in the “Sign of the Times” series is all about strategies to bridge generational gaps and serve each generation well. Read part three.

- Banking without Borders

- Now’s the Time to Lien into Whole and Participation Loan Programs

In this quasi recession we find ourselves in, financial institutions are looking to diversify portfolio assets and generate additional revenue. One way FIs are accomplishing this is by capitalizing on loan participation programs. Read this blog to learn how your FI can leverage a loan participation program for additional revenue. Read the blog here. - Strategize to Stabilize

Speaking of revenue, many financial institutions aren’t just proactively looking for additional revenue - they are facing a liquidity crisis. This is mostly due to the dramatic economic shifts reverberating off the pandemic. To stabilize balance sheets, financial institutions can add new loan products to their lineup of products and services. These products can not only stabilize your revenue but also take it to the next level. Read the blog here. - Managing Product Refunds without Burning Out Staff

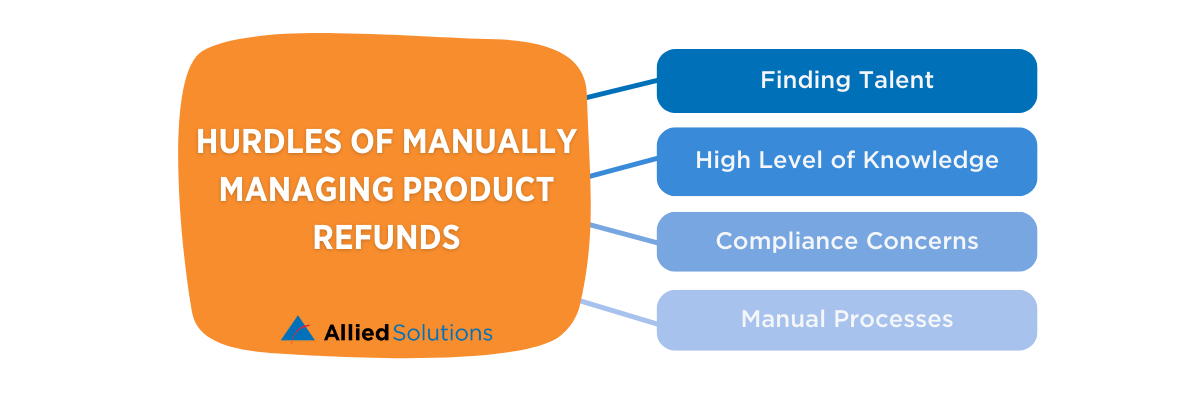

Product refunds are a primary topic of conversation - with regulators, state assemblies, and financial institutions alike. And the stakes are high for product refunds. It is no longer acceptable for financial institutions to not manage product refunds yet managing product refunds in-house brings its own set of challenges. This blog provides some tips to proactively manage the process without burning out internal staff. Learn more here.

- Aftermarket Product Refunds: Ensuring a Compliant Solution

When lenders accept the responsibility of managing product refunds, there is an overwhelming amount of regulatory compliance to consider for the end-to-end process. The compliance requirements vary by state and are evergreen on the Federal level as well. Understand what a compliant solution looks like with this blog. Click here to read the blog. - Easy Like Sunday Sky Morning

If we learned anything from social media last year, it is this: Video is king. Getting your consumers’ attention is critical for every area of your business. Although video is a critical component of a marketing strategy, many financial institutions don’t have the resources to generate original video content for marketing campaigns. Turn up your speakers to consume this content and discover what scalable video resources are available to financial institutions. Watch to video blog here.

Want more industry and content insights? Check out our entire collection of blogs here.

Stay in the know all year long with Allied Insights! Our e-newsletters include monthly and quarterly round ups of resources like these, plus news, trends, and other industry insights. Sign up here.